NIC’s weekly Executive Survey of operators in seniors housing and skilled nursing is designed to deliver transparency into property market fundamentals in seniors housing and care at a time when trends are rapidly changing—providing both capital providers and capital seekers with data as to how COVID-19 is impacting the sector. With conditions changing rapidly, there is significant speculation and hearsay, and capital has taken a step back to reassess the market. Capital, however, will be required to get through this crisis.

This narrative highlights the findings from responses collected after the start of the pandemic until now as operators experience changing market conditions due to the COVID-19 threat to residents, staff, and business operations. Detailed reports for each of the three “waves” of the survey can be found on the NIC COVID-19 Resource Center webpage under Executive Survey Insights.

Key Findings

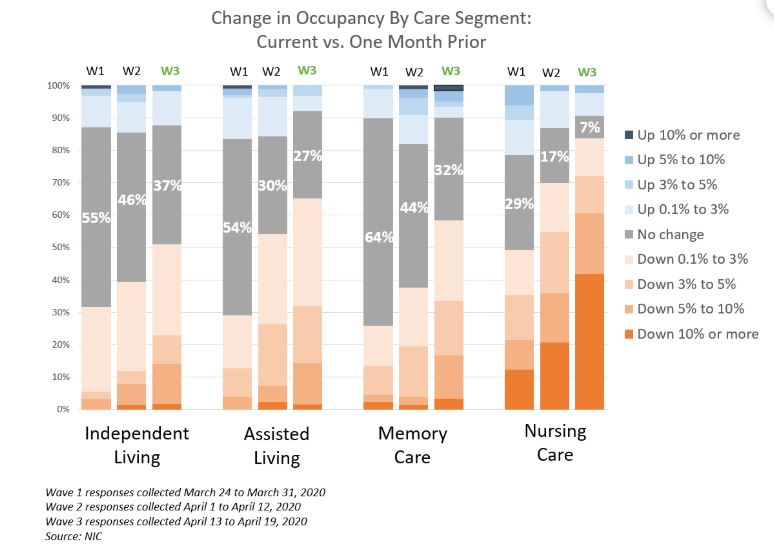

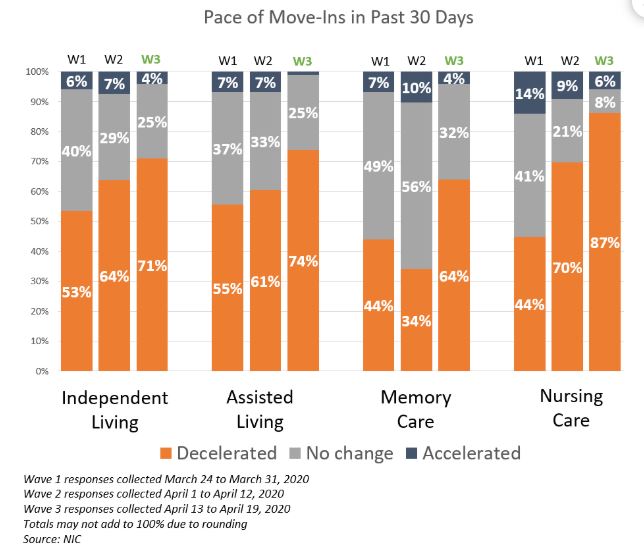

- Occupancy rates declined and move-in rates decelerated for many organizations since the surveying began on March 24, 2020. The steepest declines in occupancy and the largest percentage of organizations reporting a deceleration in move-in rates have consistently been reported for the nursing care segment.

- In Wave 3, memory care, assisted living, and nursing care segments each report a decline in the change in occupancy compared to the prior week, suggesting continued weakness in these segments in the near future.

- A larger share but still a minority of respondents in Wave 3 report an acceleration in move-outs in the past 30 days compared to prior waves of the survey.

- Across all three waves of the survey, about half of respondents expect no change in their development pipeline going forward, however, one-quarter expects their development pipeline to decrease, with most citing uncertainty as the primary reason.

- Most organizations continue to mitigate staffing shortages by increasing overtime hours, offering flexible work hours, and remote work where possible. Fewer organizations in Wave 3 than the prior two waves of the survey are hiring an agency or temporary staff and professionals from other industries.

Executive Insights Survey Demographics

Responses were collected in three “waves” March 24 through April 19, 2020 from owners and C-suite executives of 180, 146 and 105 seniors housing and skilled nursing operators from across the nation, respectively. Depending on the timeframe measured, one-half to two-thirds of respondent organizations were exclusively for-profit providers, one-half to about one-third were exclusively nonprofit providers, and under 10% operated both for-profit and nonprofit seniors housing and care organizations. Across their entire portfolios of properties, three-quarters of the organizations operate seniors housing properties (independent living, assisted living and/or memory care), roughly one-third, respectively, operate CCRCs (aka Life Plan Communities), and/or nursing care properties.

Insights from Survey Week Ending April 19

Changes in Occupancy Rates

In the most recent survey, the week ending April 19, a decline in occupancy rates from the prior month occurred across all care segments, with the deepest declines reported for the nursing care segment. In Wave 3, about 40% of organizations reporting on their nursing care beds noted an occupancy decline of ten percent or more from the prior month, up from about 20% reporting an occupancy decline of ten percent or more in Wave 2.

Regarding the change in occupancy from one week ago, the independent living segment saw the most occupancy stability. However, roughly one-third of memory care units, and under one-half to two-thirds of assisted living units and nursing care beds noted a decline in occupancy compared to the prior week.

Pace of Move-ins and Move-outs

As shown in the chart below, more organizations reported the pace of move-ins decelerated in the past 30-days in Wave 3 than in the prior two waves of the survey. Two-thirds to one-half of respondents attributed the deceleration in move-ins to a slowdown in leads conversion/sales, or resident or family member concerns. Overall, slightly fewer respondents in Wave 3 cited an organization-imposed ban on moving new residents into their communities, and slightly more cited resident or family member concerns than in Wave 2.

The nursing care segment saw the largest deceleration of move-ins in the past 30-days. Reasons cited by respondents include fewer hospitals discharging patients to post-acute care settings for rehabilitative therapy as hospitals defer elective surgeries due to the pandemic, and positive or suspected COVID-19 related moves of residents to isolated units. Nearly one-half of organizations with any nursing care beds cited an organization-imposed ban on move-ins, and nearly one-quarter cited a government-imposed ban on admitting new residents.

A larger share but still a minority of respondents in Wave 3 report an acceleration in move-outs in the past 30-days compared to prior waves of the survey. Roughly two-thirds to three-quarters of organizations reporting on their independent living, assisted living and memory care segments saw no change in move-outs—a steady decline from Wave 1 to Wave 3. Just over one-third of organizations with nursing care beds note an acceleration in move-outs in Wave 3.

Mitigating Labor Shortages and Supporting Property Staff

Most organizations continue to mitigate staffing shortages by increasing overtime hours, offering flexible work hours, and remote work where possible. Fewer organizations in Wave 3 than the prior two waves of the survey are hiring an agency or temporary staff and professionals from other industries. However, more organizations are beginning to offer additional paid sick leave to support property staff. Survey write-in comments indicate other tactics are being employed such as increasing wages, offering shift bonuses and incentive pay, access to on-site groceries and meals, emergency financial support programs, and temporary housing.

A recent NIC blog post entitled “We Feel We Are Alone in a War Zone” incorporates comments from earlier survey respondents that reflect the impact of the COVID-19 crisis on a human level. One of the key concerns reflected in survey comments is a lack of available, accurate, and timely testing. Survey respondents also worry about the effect that the pandemic is having on already strained labor force issues.

Development Pipeline Expectations

Like previous waves of the survey, one-half of respondents in Wave 3 expect no change in their development pipeline going forward, however one-quarter expects their development pipeline to decrease citing uncertainty as the primary reason. Some of the respondents shared concerns about the economy, restrictions on moving new residents in, access to capital/debt, and cash flow and liquidity issues. NIC MAP® data has shown deceleration in new construction relative to inventory trending for several quarters.

Going Forward

These are unprecedented times and our deepest concerns go out to those directly impacted by the COVID-19 pandemic and those on the frontline keeping residents of seniors housing and skilled nursing communities safe. These dedicated women and men and their families are making extraordinary sacrifices in these difficult times to protect and serve the most vulnerable among us.

NIC wishes to thank survey respondents for their valuable input and continuing support for this effort to bring clarity and transparency into market fundamentals in the seniors’ housing and care space at a time where trends are rapidly changing. Your support helps provide both capital providers and capital seekers with data as to how COVID-19 is impacting the space, helping leaders make informed decisions.

If you are an owner or C-suite executive of seniors housing and care properties and have not received an email invitation but would like to participate in the current Executive Survey, please click here for the current online questionnaire.