As part of SBA’s coronavirus debt relief efforts, they will pay 6 months of principal, interest, and any associated fees that borrowers owe for all current 7(a), 504, and Microloans in regular servicing status as well as new 7(a), 504, and Microloans disbursed prior to September 27, 2020. This relief is not available for Paycheck Protection Program loans or Economic Injury Disaster loans. Borrowers do not need to apply for this assistance. It will be automatically provided as follows:

- For loans not on deferment, SBA will begin making payments with the next payment due on the loan and will make six monthly payments.

- For loans currently on deferment, SBA will begin making payments with the next payment due after the deferment period has ended, and will make six monthly payments.

- For loans made after March 27, 2020 and fully disbursed prior to September 27, 2020, SBA will begin making payments with the first payment due on the loan and will make six monthly payments.

The SBA has notified 7(a), 504 and Microloan Lenders that it will pay these borrower loan payments. Lenders have been instructed to refrain from collecting loan payments from borrowers. If a borrower’s payment was collected after March 27, 2020, lenders were instructed to inform the borrower that they have the option of having the loan payment returned by the lender or applying the loan payment to further reduce the loan balance after SBA’s payment.

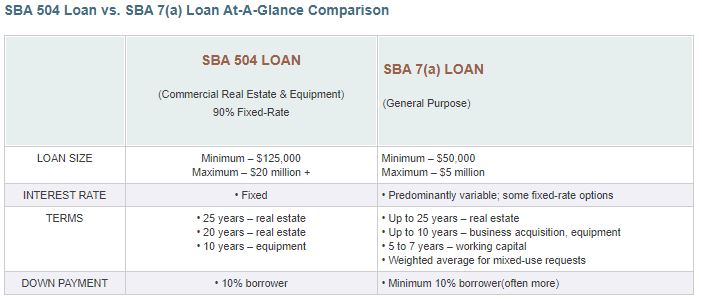

With an SBA 504 loan, money can be used to buy a building, finance ground-up construction or building improvements, or purchase heavy machinery and equipment. 7a loan proceeds can be used for short-term or long-term working capital and to purchase an existing business, refinance current business debt, or purchase furniture, fixtures and supplies.

Be sure to visit our loan program page for all senior housing loans.