How much seniors housing will be needed for tomorrow’s aging baby boomers?

A frequent question NIC receives is how much seniors housing will be needed for tomorrow’s aging baby boomers. Using the most recent U.S. Census population projections, NIC has estimated the number of seniors housing units that possibly will be needed through 2040. Since projections are as much art as they are science, we have also created a few scenarios that project needed new supply based on different penetration rates and different household age cohorts.

It is important to note, however, that these projections are based solely on demographics and do not consider consumer preferences. This is particularly important because the emerging cohort for seniors housing is the baby boomers, and they are known as a generation that does not do things the same way as prior generations. Hence, assumptions on future usage and penetration rates may be different than today.

Base Case Results

For the base case analysis, we used the age 80-plus household cohort. Prior analyses have used age 75-plus households. We believe that the age of residents in seniors housing has increased in the last decade, with many observers placing the typical age of a resident higher than 80. Hence, the 80-plus household cohort better represents today’s residents. For purposes of sensitivity analysis, we also conducted scenarios using 75-plus household and 85-plus household projections.

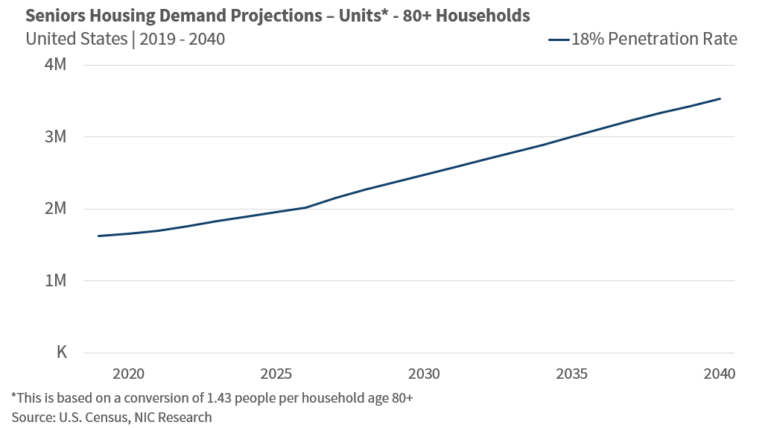

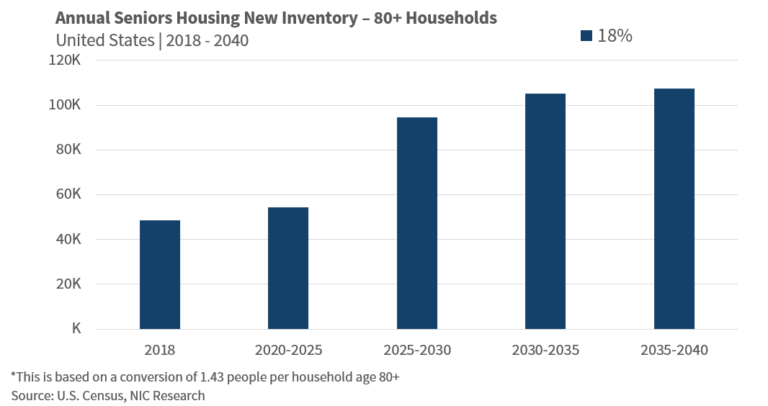

Based on our estimates of existing inventory and 80-plus households, the current penetration rate for the 80-plus household cohort is 18% (1.592 million units / 8.860 million households = 0.18). With this penetration rate and age cohort, there are an estimated 881,000 additional units of seniors housing inventory that would be needed to serve seniors between 2019 and 2030. Due to demographic patterns, the rate of change in demand accelerates further out, with a need for roughly 54,000 units per year required between 2020 and 2025; 95,000 between 2025 and 2030, and 105,000 between 2030 and 2040 (see charts below). In the immediate term, however, 31,000 additional units are needed in 2019; 36,000 in 2020; and 41,000 in 2021—fewer units than were added to inventory in 2018.

Scenario Analysis

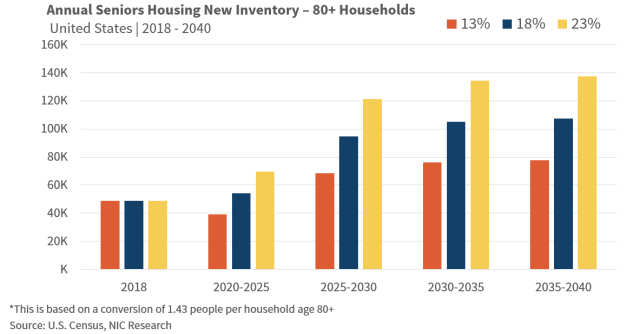

The first set of scenarios looks at different penetration rates for the 80-plus household cohort. If the penetration rate were to increase to 23% from 18%, there would be an additional 247,000 units needed through 2030 compared with an 18% penetration rate (1.1 million units versus 881,000 units). And at a 13% penetration rate, a total of 638,000 units would be needed through 2030 (244,000 fewer than in the base case scenario).

The chart below looks at the annual inventory growth needed for 5-year intervals through 2040 under these three penetration rate scenarios. As the chart indicates, for both the base case (18% penetration rate) and the higher penetration rate scenario (23% penetration rate), the pace of annual inventory growth needs to be higher than the rate recently experienced in the U.S., i.e., more than the estimated 48,000 units that were added to the stock of seniors housing in 2018.

For the 2020-2025 period, nearly 70,000 units per year would need to be added to the stock of seniors housing in the 23% penetration rate scenario. This accelerates to 121,000 in the 2025 to 2030 period.

In the lower 13% penetration rate case, roughly 39,000 units of new inventory per year would be needed between 2020 and 2025, fewer than the recent pace of inventory growth. It is not until 2023 that the demographically-driven demand would require more than today’s pace of inventory growth—in that year, nearly 56,000 units of new inventory would be needed.

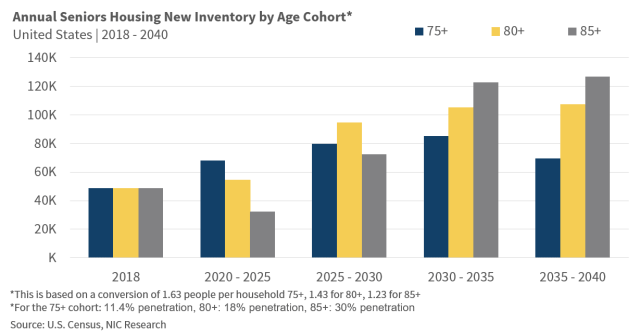

A second set of scenarios center on the age of the residents. If today’s inventory was used by only 85-plus households, the penetration rate would climb to 30%. A higher penetration rate and fewer absolute households suggests fewer incremental units would be needed in the near term and more units would be needed in the long term. The chart below depicts this pattern.

In the 2020-2025 period, the 85-plus cohort would need an additional 32,000 units to be built each year to satisfy demand, fewer than were built in 2018. From 2025 to 2030, 73,000 units per year would need to be added and, in the 2030 to 2035 period, this rises to 123,000 units.

For the 75-plus household base case and an 11.4% penetration rate, a total of 874,000 units would need to be built between now and 2030. In five-year intervals, this equates to 68,000 units between 2020 and 2025 and 80,000 between 2025 and 2030.

In the near term, fewer units are required and less inventory theoretically needs to be built for the 85-plus cohort than either the 75-plus or 80-plus cohort would suggest because there are simply fewer 85-plus households, even at a higher penetration rate of 30%. This is the case until the 2030 period when annual incremental demand equals more than 120,000 units.

Conclusion. This analysis presents several scenarios that project future seniors housing needs at different penetration rates and for different age cohorts. In aggregate, the results show that significantly more housing would be needed for America’s aging population if today’s penetration rate is maintained or grows over the long term. Moreover, even if the penetration rate were to decline, sheer demographics would support future inventory growth, as the lower 13% penetration rate for the 80-plus household cohort scenario shows.

The timing of when new supply is needed is important to consider, however. Under the base case scenario of an 18% penetration rate for 80-plus households, incremental inventory growth slows to less than 32,000 units in 2019, 36,000 in 2020, and 41,000 in 2021. It is not until 2022 that the demographically-driven demand estimates suggest that the pace of inventory growth needs to exceed the 2018 pace of supply growth. After 2021, the pace of incremental new supply accelerates and peaks at 135,000 units in 2027. If the typical age of entry of a resident of seniors housing is 85 or higher, then the need for additional inventory grows more slowly in the near term and doesn’t reach the 2018 pace of new supply growth until 2026.

As stated at the beginning of this article, it is also important to keep in mind that these estimates are solely based on demographic demand and do not consider changing consumer preferences regarding their housing and care needs.

[1] Note that this write-up is a consolidated version of a longer analysis that carefully explains the methodology, assumptions and considerations that need to be understood. It can be found here.

By Beth Burnham Mace and Anne Standish