The senior housing and care sector is generating buzz. Recent surveys from Institutional Real Estate Inc. (IREI) and National Real Estate Investor (NREI)/National Investment Center for Seniors Housing & Care (NIC) and results from this year’s Emerging Trends in Real Estate® survey show keen investor interest. Dollars are flowing into the sector. Debt providers set generous annual allocations. Dedicated and commingled private equity funds are being raised as institutional investor interest accelerates. Some core funds even have senior housing allocations. Nearly 60 percent of the three largest health care REITs’ investments are in senior housing. And foreign capital has arrived, with 9 percent of the top 20 buyers’ expenditures originating from China in the past two years.

Indeed, deals are being done. In the second quarter of 2018, more than $13.6 billion of transactions occurred on a rolling four-quarter total for the senior housing and care sector. A lot of favorable considerations. So, why the interest? First, private equity returns for senior housing properties have outpaced those of other commercial real estate for the last ten years on both appreciation and income return performance. According to first quarter 2018 NCREIF Property Index (NPI) results, the total return for senior housing on a ten-year basis was 10.52 percent—far outpacing the overall property index of 6.09 percent and apartment returns of 6.1 percent. Second, investment in senior housing provides diversification because the sector is not as cyclical as other property

types and was shown to be recession-resilient during the global financial crisis. Its “needs-based” demand characteristics allowed assisted living to withstand many of the downwind recession pressures faced by other commercial real estate sectors. Third, while NOI growth may experience a dip in 2018, Green Street Advisors projects that senior housing will outpace the broader major-sector NOI averages in 2020, 2021, and 2022. Fourth, with nearly two of every three properties built before 2000, the inventory of senior housing properties is relatively old, and often a property refresh is needed for design, functionality, and efficiency. Fifth, senior housing is increasingly recognized as a critical part of the solution for population health efficiencies and health care cost containment—a growing social, economic, and political reality. Sixth, transparency and understanding of the sector are rising, which provides a more knowledgeable and disciplined capital

market. Information about market fundamentals and capital market conditions is readily available from sources such as the NIC MAP® Data Service and Real Capital Analytics (RCA), as well as analysts’ reports on health care REITs. And lastly, as transaction volumes increase, investors have become more comfortable knowing that multiple exit strategies are likely.

What about demographics? Well, the perception of immediate demographic-driven demand by the baby boomers for senior housing is different from reality. Today’s typical senior housing resident is estimated to be 83 years of age or older. The oldest baby boomer today is 72, so it will be another ten years until the swell of baby boomers become residents. However, we have now passed the nadir of births in the mid1930s, the years when today’s 83-year-olds were born. And growth in these senior-housing-aged cohorts is beginning to increase. Based on recently updated estimates from the U.S. Census Bureau, there were 8.5 million individuals aged 83 or more in 2017. In 2018, an additional 138,000 people are projected to age into the 83-plus cohort. By 2025, the U.S. Census Bureau estimates that this cohort will comprise 10.2 million people, for an increase of 1.6 million people over the eight-year period from 2017 to 2025.

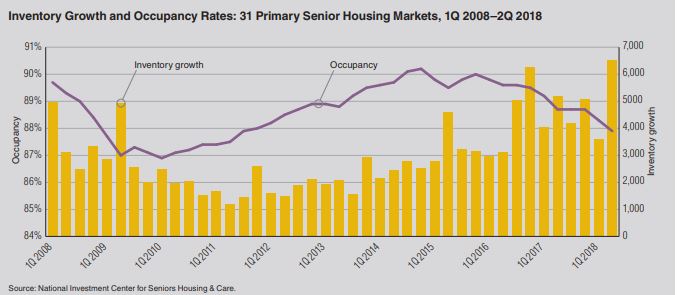

Challenges exist. Rarely does an opportunity occur where there are no challenges. For senior housing, two challenges currently dominate: unit supply and labor shortages. First are supply/demand imbalances and occupancy challenges in some—but not all—markets. In the second quarter of 2018, the occupancy rate for senior housing slipped back to 87.9 percent, the lowest rate in seven years as inventory growth outpaced net demand. However, a very wide 16-percentage-point difference exists between second quarter 2018 occupancy rates for the most occupied senior housing market (San Jose at 95 percent) and the least occupied (San Antonio at 78.6 percent), according to NIC MAP® Data Service. Supply has been a more notable issue in many of the Sunbelt metropolitan markets, and less remarkable in the higher-barrier-to-entry markets such as northern California.

The second challenge is the labor market. Increasingly, operators are reporting labor shortages in all occupations across their operating platforms, ranging from care managers to executive directors. With the national unemployment rate falling below 4 percent, the challenge of recruiting and retaining employees is expected to only grow. Shortages in the health care professions as well as in other industry sectors, such as the construction trades, are slowly putting upward pressure on wage rates. In the 12 months ending in June, average hourly earnings rose 2.7 percent—up from 2.5 percent on average in 2017.

Taken in its entirety, it is a time for a cautious near-term approach in the senior housing sector. Currently, some operators face challenging market conditions since supply has outpaced demand. Operators and investors who underwrote deals with 90 percent or 95 percent stabilized occupancy rates a few years ago are facing pressures as they open into markets with 85 percent or lower occupancy rates. In a time of rising expense pressures, where average hourly earnings for assisted living operators are increasing at a 5 percent annual clip, achieving NOI expectations may be difficult.

On the other hand, investors who have partnered with solid operators located in strong markets are seeing outsized investment returns today. And for those who are not yet seeing these returns, they can perhaps draw comfort from the prospects of the demographics coming, although perhaps not immediately. For those investors with capital, holding money on the sidelines may be a good near-term strategy, as a growing number of distressed deals need capital infusion, recapitalizations, and new partners.

National Investment Center for Seniors Housing & Care (NIC)