Middle Market Success Stories: Moving from Theory to Reality

In the spring of last year, NIC presented the findings of its “Forgotten Middle” study, which they conducted in conjunction with the National Opinion Research Center (NORC) at the University of Chicago. This research, for the first time, projected the size, needs, and financial limitations of middle-income Americans in the areas of housing and healthcare.

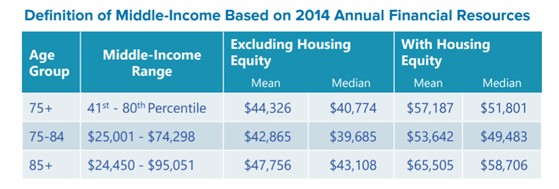

Those considered “Middle Market” had incomes in the 41st-80th percentiles. Their incomes are too high to qualify for Medicaid but too low to afford today’s senior housing product. To provide a context of what this means in terms of dollars, a summary of those incomes, with and without home equity, is below. The median annual income of this Middle Market group is $51,800.

Source: National Investment Center for Seniors Housing & Care (NIC)

The study was initially unveiled at two different events (both of which I was involved in as the CMCO of NIC at the time). One was in NYC, which focused on the implications and opportunities for capital providers. The other centered around healthcare policy implications, which took place in Washington, DC. The study opened some eyes and made it abundantly clear that the senior living industry needs to acknowledge and respond to the realities that surfaced by the study.

One of the most compelling data points from this research is that the number of seniors 75+ in this middle-income group will grow to 14.4M, an increase of over 50% since 2014. If this increase in the market translates into increased category consideration, the sector has an unprecedented growth opportunity.

Theory vs Reality

In May 2020, Argentum hosted a webinar titled “Middle Market Success Stories”, which caught my attention. I, along with many others, was eager to hear which companies are seeing success in the Middle Market and how they are doing it. In addition to Beth Mace, Chief Economist at NIC, the panelists were Jerry Finis, CEO of Pathways to Living; Bill Pettit, President of R.D. Merrill; and Joel Mendes, Senior Director of JLL Capital Markets.

First, it’s important to note that it would be more accurate to position the webinar as “Innovative Ideas to Achieve Success in the Middle Market” as the discussion revolved around a not-yet-proven model that would decrease monthly fees from an average of $6000 a month to $4000 a month in order to broaden the addressable market to middle-income seniors.

I had additional follow-up conversations with Jerry Finis and Bill Pettit, who were very helpful in clarifying the details of this, as of yet, theoretical model.

Three Requirements

Joel Mendes offered three significant conditions that must be met in order to make a Middle Market product scalable:

- Offer rents that are affordable on a private pay basis to middle-income seniors, as defined above

- Maintain quality care

- Yield an acceptable return on investment to a for-profit owner/operator

Areas of Opportunity

With those parameters established, the focus shifted to exploring the operating and financial requirements to tap into this enormous opportunity. Five levers were identified as opportunities to cut costs or create cost efficiencies:

- Sales and marketing

- Food and dietary

- Activities

- Housekeeping

- Administrative

There are numerous ways to reimagine these costs and the associated operations, but I wanted to highlight some of my key takeaways that are both specific and overarching:

1. The middle-income market is diverse.

One size does not fit all. It is a more ethnically diverse, educated, and unmarried market than today’s residents. And boomers are more individualistic than today’s residents, which will require more niche experiences and living environments.

This provides opportunities to, for example, make activities a la carte versus included and for staff to proactively connect people with other residents with similar interests — so they’re a facilitator versus a ringleader. To succeed, it will be important to clearly communicate the product and available services of the community in the marketing and sales process so there is alignment with expectations.

2. The biggest obstacle is the industry itself.

Bill Pettit began the description of how Merrill Gardens thinks about their product and service model by saying, “Possibly the biggest obstacle we have as an industry in serving the middle income senior is our own vision as to what they (the market) will accept, what will benefit them, and how we envision the full-service model.”

He went on to say, “Our obstacle is how we view an ‘acceptable’ model and our own filter as to what a senior will accept in service to achieve the benefits of nutrition, fitness, intellectual stimulation, ease of socialization, access to care, and security.” The idea to “go back to see the future” captured the reminder that when senior housing was in its early years, it was based primarily on a social vs. care model.

3. Food — and the costs associated with how it’s served — is the biggest opportunity to reduce costs.

Care cannot be compromised. And financial yields are critical for continuous innovation and investment. But there is a wide range of dining options beyond today’s model that can dramatically reduce the cost of the food itself and the cost of labor to serve it.

Dining is such a large percentage of operating costs and potentially the easiest service to pare down. Alternative models that were discussed might include:

- Less formal meals. Hotels serve as great examples of ways to provide quality food at a lower cost through more self-management. The communal dining room with set mealtimes and full-service waitstaff is a model that isn’t necessarily desired or expected.

- Fewer formal meals or reduced hours. Merrill Gardens, as an example, has an open kitchen 7 am to 7 pm for three meals a day and these staff represents 70% of operating costs when combined with costs of care. A simplified meal program for the Middle Market product that could reduce the kitchen and serving staff to one shift would reduce costs while keeping residents healthy.

The “Ah-Ha” Moment

As a career marketer who has had P&L and revenue responsibility, I’ve seen how cutting sales and marketing costs (beyond creating efficiencies) can have a significantly negative impact on financial success. However, based on my experience in other categories and perspectives shared by the panelists, there are financially compelling benefits of the Middle Market product that go far beyond margin and a pro forma P&L. By offering a price point and product that is affordable to 50% more consumers, there is high potential for:

- 1. An increase in Marketing Return on Investment (MROI)

Reaching 50% more potential customers will not require a 50% increase in marketing spend. - Improved leads and conversion rates — a customer who is more informed, qualified, and motivated is more likely to make an inquiry and convert to a resident. The marketing communications and sales process must deliver on the Middle Market value proposition and experience (no smoke and mirrors).

- By offering a truly differentiated product through the lower price point, there is potential for strong word-of-mouth, which can result in an increase in “unpaid leads”; those that are not driven by direct mail, digital advertising, or third party referral services.

2. Increased Lifetime Value (LTV)

By offering a lower price point, prospective residents can afford to move in earlier. Jerry Finis has seen this in his affordable communities, where 15% of residents at move-in age are younger than 70. By decreasing the average move-in age, there are multiple benefits:

- The lifetime value (LTV) of the resident increases

- Turnover is reduced so the costs of sales, marketing, and administrative duties normally expended to fill units are reduced

- Younger residents can bring their energy to contribute to activities, decreasing reliance on the Activities Director

Owner/operators like Merrill Gardens and Pathways to Living are actively exploring ways to create Middle Market products and brands, so progress is being made. But the clock is ticking as the baby boomers enter the senior living market, many of whom have insufficient retirement savings and home equity. In the coming years, it will be paramount for the industry to roll up its sleeves, get creative, and do market research to deeply understand their unique consumer dynamics. In doing so, the sector has a great opportunity to offer a Middle Market product that the future consumer can not only afford but actually wants.

Now, we just have to go and do it.

Written by Mary Ann Donaghy |