The pressures of the Covid-19 pandemic are pushing investors to become more interested in need-based product types, such as assisted living and memory care communities. At the same time, there is increased spread in Class A versus Class B acquisitions, illustrating “an investor flight to quality throughout the pandemic.”

That’s according to the latest CBRE Seniors Housing & Care Investor Survey, which details how investors saw the senior living market in the second half of 2020. The survey, released Thursday, includes responses from a cross-section of industry stakeholders, such as private capital investors, brokers, developers, and institutional investors.

Assisted living again ranked No. 1 for investor interest in the second half of 2020, with 33% of respondents identifying the product type as the biggest opportunity for investment. Nearly a quarter (22%) of respondents said independent living communities presented the biggest opportunity for investment, while 15% said the same about active adult. That’s a stark difference from CBRE’s previous survey this year — which closed at the end of February — that showed a 30% share assisted living, 27% for independent living and 28% for active adult communities as the biggest investment opportunity.

Investors also became more interested in memory care communities, going from 4% in the first half of this year to 12% in the second half identifying it as the biggest opportunity for investment.

Regarding occupancy trends, more than 70% of respondents said they expect occupancy to increase over the next 12 months, compared to just 53% who said that in the first survey. Just 15% expect occupancy to remain flat in the coming year, while 14% said it would further decrease.

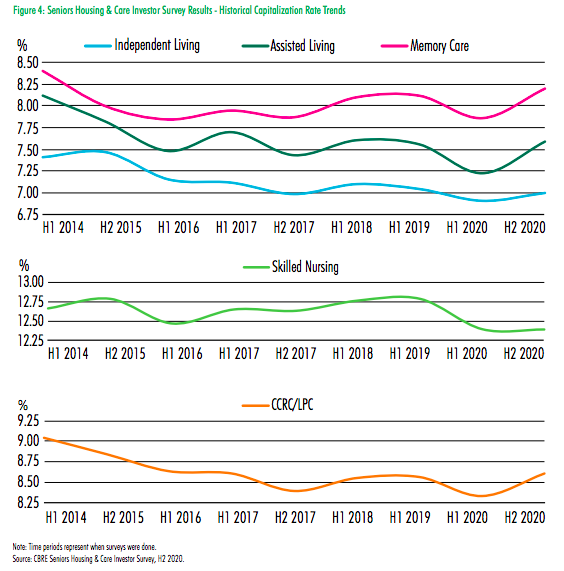

The survey also showed an increase in capitalization rates, with active adult cap rates having the largest increase— an average 80 basis points over the previous survey. Cap rates also increased for assisted living and memory care communities by an average of about 35 basis points, according to the survey.

Investors also became more interested in memory care communities, going from 4% in the first half of this year to 12% in the second half identifying it as the biggest opportunity for investment.

Regarding occupancy trends, more than 70% of respondents said they expect occupancy to increase over the next 12 months, compared to just 53% who said that in the first survey. Just 15% expect occupancy to remain flat in the coming year, while 14% said it would further decrease.

The survey also showed an increase in capitalization rates, with active adult cap rates having the largest increase— an average 80 basis points over the previous survey. Cap rates also increased for assisted living and memory care communities by an average of about 35 basis points, according to the survey.

Capitalization rates for Class A assets increased by 27 basis points. Excluding active adult properties, however, rates for Class A assets showed an increase of only 15 basis points, standing apart from Class B and Class C assets, which saw cap rate increases of 28 and 22 basis points, respectively.

“The increased spread in the Class A versus Class B rates, also indicated by the reduced delta between Class B and Class C rates, illustrates an investor flight to quality throughout the pandemic,” the report’s authors wrote.

Looking ahead, 53% of respondents expect no change in cap rates in the coming year, while 36% said they expect to see cap rates increase and 11% said they expect cap rates to decrease.

By Tim Regan |