Exclusive research shows seniors housing continues to have a strong outlook.

Stakeholders across the seniors housing sector have been keeping a careful eye on the robust construction pipeline that has been bringing new supply and increased competition to many metros across the country. Yet results from the sixth annual NREI/NIC seniors housing survey show a positive outlook over the coming year for sector performance and access to capital, along with predictions for a steady pace of transaction activity. A majority of respondents in the latest piece in the NREI Research Series believe the sector will continue to perform well with both occupancy and rent growth in the coming year.

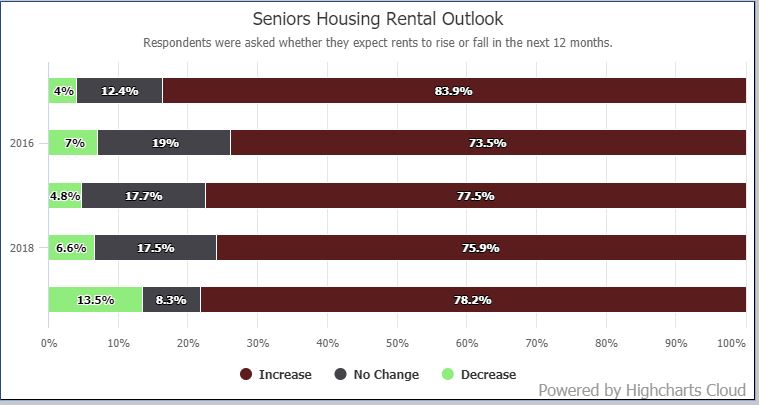

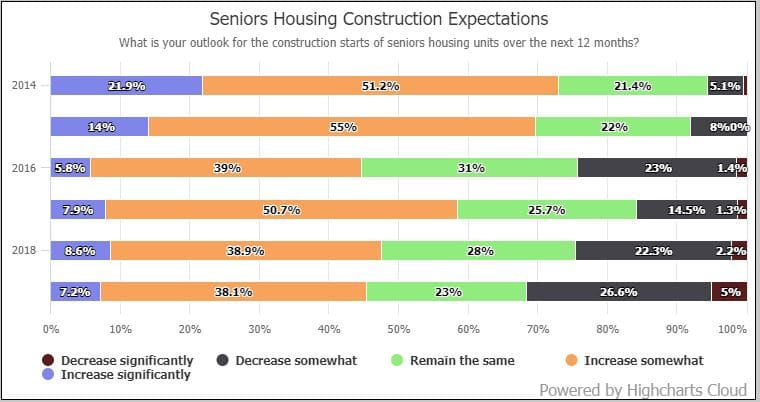

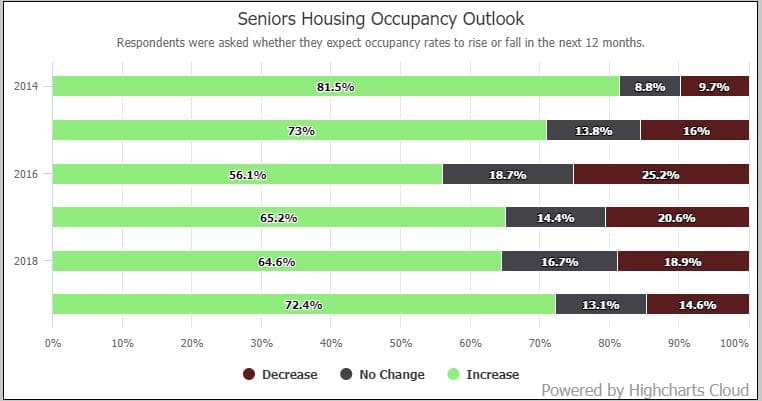

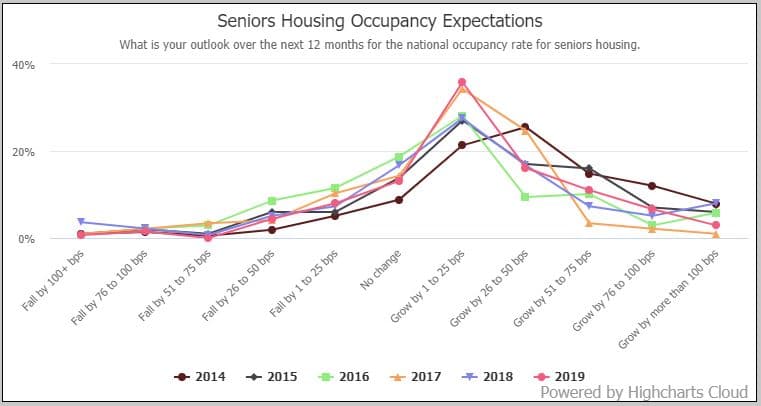

In all, 72 percent anticipate an increase in occupancies over the next year versus 65 percent who held that view in the 2018 survey, and an even higher volume, 78 percent, expect rents to rise in the coming year. Although that optimism is surprising, it may be a reflection that respondents are also more likely to believe that construction starts will decrease over the next 12 months, notes Beth Burnham Mace, chief economist and director of outreach at the National Investment Center for Seniors Housing & Care (NIC). Nearly one-third of respondents (32 percent) are predicting a decrease in construction starts over the next 12 months, which is up from 24 percent in the 2018 survey. Meanwhile, 45 percent of respondents expect to see an increase in seniors housing starts and 23 percent anticipate no change. “There is still some concern about construction, but it is a little bit less than we have seen in the past,” says Mace. Another factor contributing to sector optimism is that a majority of respondents (76 percent) do not think construction activity will result in overbuilding.

Views of slowing construction starts are consistent with NIC data, which does show signs of slowing. Construction starts during the second quarter amounted to 3.0 percent of total existing seniors housing inventory, which is down from 4.3 percent a year ago. “Especially for assisted living [AL], there is a clear downward trend in starts activity,” says Mace. As of the second quarter, construction starts on AL properties amounted to 3.5 percent of total existing inventory, which is down compared to 6.5 percent in late 2015. “So, that is a pretty significant slowdown and that’s what respondents in the survey may be starting to notice,” says Mace.

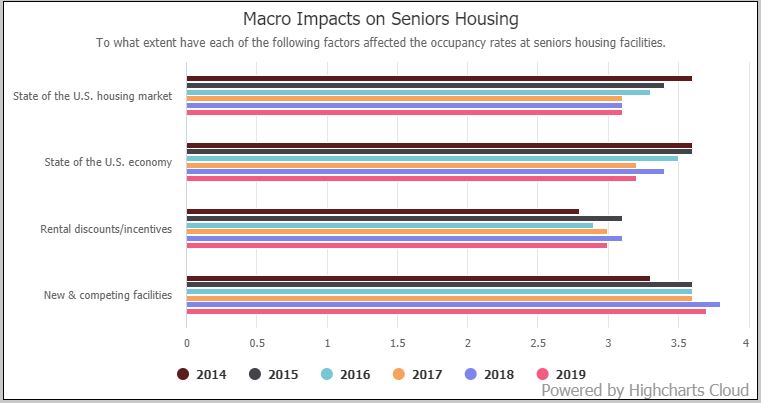

Construction has been creating a buzz in the industry as both investors and lenders evaluate the implications for occupancy levels. Over the past five years, respondents have said that new and competing facilities have had the biggest impact on occupancy rates, and results of the 2019 survey are consistent with that trend. On a scale of one to five, with five being the most significant impact, 63 percent of respondents rated the impact of new and competing facilities as either a five or a four. However, that percentage is down compared to 69 percent a year ago. Again, that data suggests that there is still concern about construction, even though concern is a bit less than what past surveys have shown.

“The construction pipeline has definitely slowed, but there is still a fair amount of supply to absorb in certain markets. And as long as capital is flowing into the sector, developers will continue to build,” says Bill Glascott, a chief investment officer with Green Courte Partners, a Chicago-based private equity investment firm. People are paying attention to that new supply, and capital is being more selective on which projects get funded. In addition, rising construction costs and wages are putting pressure on developer margins, which dampens that activity as well, he adds.

Respondents also rated the state of the U.S. economy as a very or somewhat significant factor at 43 percent; and state of the U.S. housing market at 39 percent. Rental discounts and concessions were viewed as having the lowest impact on occupancies at 34 percent.

New players continue to enter

The common theme in the seniors housing sector in recent years has been more and more capital flowing to the sector on both the equity and debt side. “Over the last five years there has been an increasing level of interest in the seniors housing space, and in the last year alone we have continued to see new entrants,” says Charles Bissell, managing director, seniors housing capital markets, at JLL. Those new players run the gamut from foreign capital and new private equity funds to non-listed REITs and other institutional capital sources. In fact, the market is seeing some of the largest funds ever raised that are dedicated to seniors housing, he adds. For example, PGIM Real Estate’s latest seniors housing fund, Senior Housing Partnership Fund VI, has a target capital raise of $750 million.

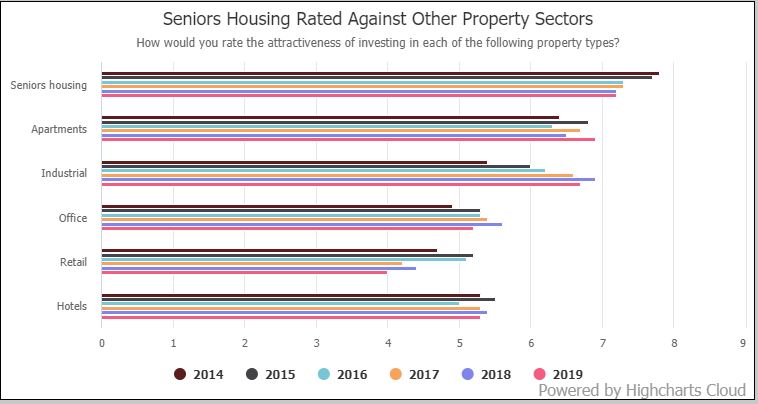

Respondents continue to view seniors housing as the most attractive property type compared to other sectors. When asked to rate the attractiveness of different property sectors on a scale of 1 to 10, seniors housing scored a 7.2, putting it ahead of apartments at 6.9 and industrial at 6.8. The respondent base could be skewing results a bit in favor of seniors housing. However, other surveys have found similar trends. For example, the ULI Emerging Trends for 2019 found that seniors housing ranked second among commercial real estate types for the best investment property sector and third in terms of best development prospects.

Factors that continue to fuel investor interest are a strong performance and a big demographic tailwind for demand powered by the aging population. According to the NCREIF index, stabilized seniors housing properties are consistently outperforming both apartments and the total NCREIF Property Index. The five-year annualized return for seniors housing is 13.1 percent compared to 8.2 percent for apartments and 9.1 percent for the total NPI. Investors also like seniors housing because it is viewed as somewhat of a recession-proof, needs-based product.

PGIM Real Estate has been an active investor in seniors housing since the late 1990s and has had a front-row seat to the continued evolution of the market that has attracted more institutional investors. “Some of the capital coming into the industry is really good because it creates liquidity, but it also does increase competition overall,” says Steve Blazejewski, managing director, seniors housing, at PGIM Real Estate. That being said, there are still some really good opportunities for acquisition and development, he adds.

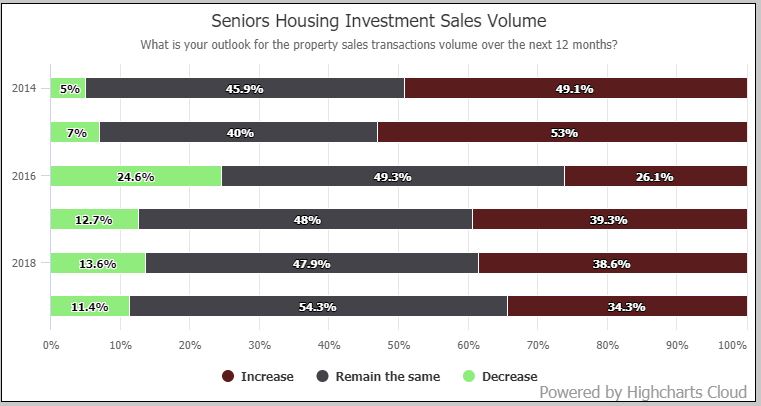

Investor interest is generating an active pipeline for sales transactions. According to the research firm, Real Capital Analytics, preliminary second-quarter data shows a rolling 12-month volume of seniors housing property sales of $15.8 billion, which is up 1.8 percent year-over-year. More than half of respondents (55 percent) think investment sales will remain the same over the next year, while 34 percent expect sales to increase and 11 percent predict a decline.

Mixed views on cap rates

According to Real Capital Analytics, cap rates for seniors housing and care assets have been moving higher since hitting a low of 6.8 percent in the fourth quarter of 2017. Preliminary second-quarter data shows that cap rates rose 141 basis points to an average of 7.7 percent.

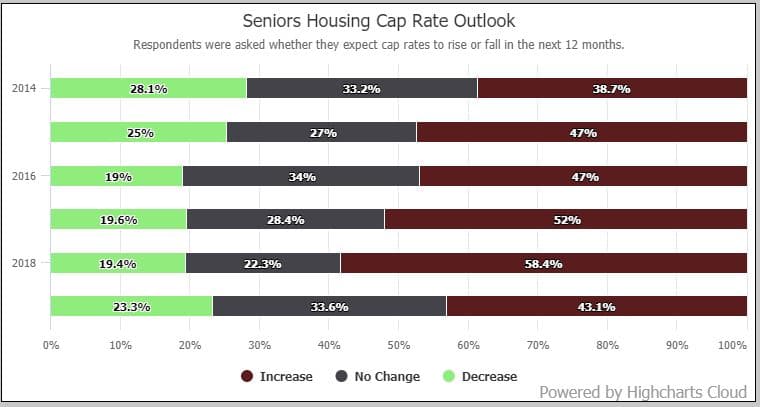

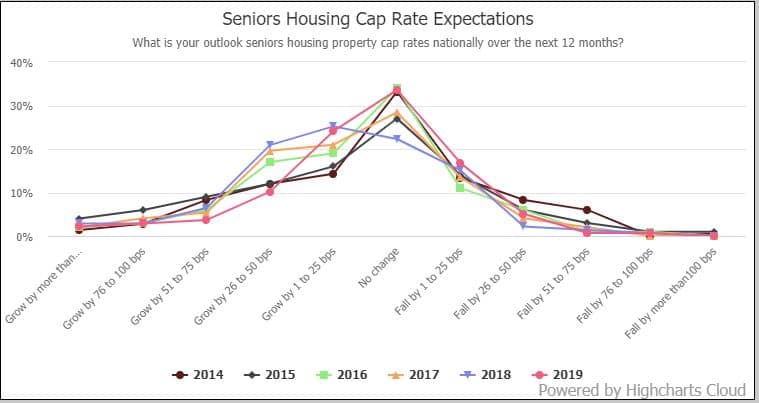

Respondent views are split on expectations for cap rates in the coming 12 months, although more are inclined to believe cap rates will move higher. In all, 43 percent said cap rates will increase; 34 percent think there will be no change and 23 percent anticipate a decrease. The sentiment is more divided compared to a year ago when 58 percent of respondents were predicting an increase in cap rates. If cap rates do move, the general consensus is that any movement – either to the positive or negative – will be slight, with a mean change over the next 12 months of 9.1 basis points.

Although cap rates have been somewhat flat over the past three to five years, there is more pricing disparity creeping in, notes Blazejewski. “We are seeing the market absolutely reward newer assets, and particularly the top quality operators,” he says. “Conversely, we are seeing the market punish older assets and those that are vulnerable to new supply and competition.” For example, class-A assets with a best-in-class developer or operator are selling for cap rates in the low 5-percent range. At the other side of the spectrum, older assets are trading for cap rates ranging from 6 to 7 percent, he adds.

“Since we bought our first property in 2015, we’ve observed cap rate compression in conjunction with an increased appetite for independent living assets,” says Glascott. Green Courte Partners is currently investing its fourth fund, Green Courte Real Estate Partners IV, which has about $500 million of committed equity capital. Low-acuity seniors housing is one of three active strategies for the fund, and so far, accounts for nearly half of the capital deployed on behalf of the fund. “We’ve been more active in value-add deals, where we believe we can buy at a discount to replacement cost and price rents competitively while giving us a basis that is somewhat defensive to planned or potential new supply in a given market,” says Glascott.

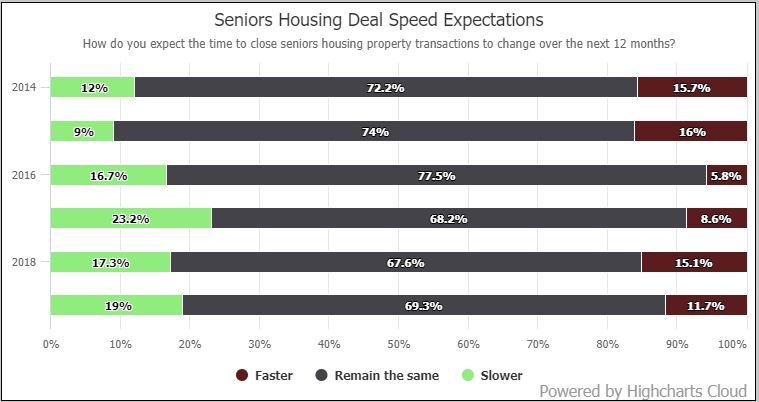

A majority of survey respondents predict that the time to close on transactions will remain the same at 69 percent, while 19 percent think deals could be slower and 12 percent believe closings could move faster in the coming year.

“In some cases, there is a bit of a gap between the seller’s desired pricing and what buyers are willing to pay,” adds Bissell. That mostly relates to assets that are not fully stabilized, he says. However, even with that gap, there is a robust pipeline of deals.

Respondents bet on lower rates ahead

One of the biggest moves in the 2019 survey relates to expectations for interest rates. Only 25 percent of respondents believe rates will rise in the coming year, which is a dramatic drop compared to 84 percent who thought rates would move higher in the 2018 survey. Of course, at that time, the Fed did raise rates. But most recently, the Fed reversed course and reduced its target rate by 25 basis points. “I think that reflects that respondents are paying attention to what’s going on at the Fed,” says Mace.

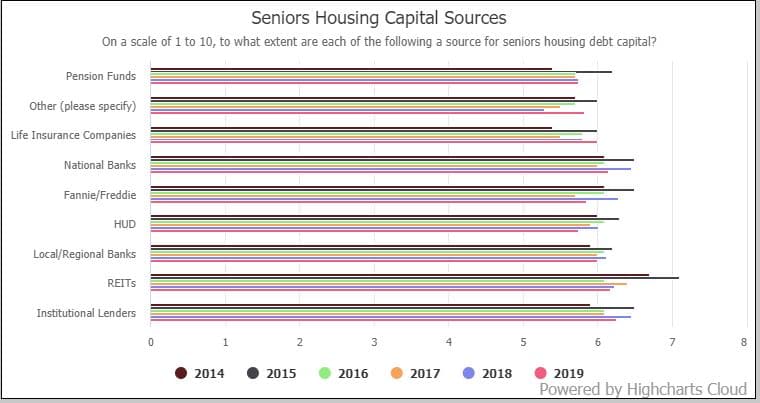

When asked to what extent each of the following is a source of debt capital for seniors housing on a scale of 1 to 10, national banks and institutions rated the highest with a mean score of 6.5. However, local banks, the GSEs and REITs all scored high with scores above 6.0.

Construction and balance sheet financing is widely available, and Fannie Mae, Freddie Mac, and HUD continue to provide strong financing for long-term, non-recourse permanent loans, notes Neal Raburn, a managing director on the seniors housing finance team at Greystone. “Most of our capital partners have an increasing appetite for seniors housing year-over-year,” he says. In addition, just as there have been more players entering the sector on the equity side, there have also been new entrants on the debt side over the past few years. In particular, there have been more banks and also more debt funds that have become active in seniors housing, adds Raburn.

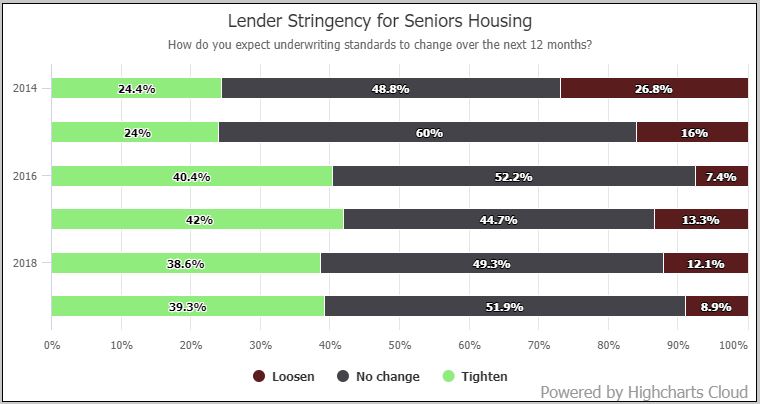

Overall, most respondents expect the lending environment for seniors housing to remain the same over the next 12 months. Half of the respondents (52 percent) think underwriting standards will likely remain the same in the coming year, while 39 percent said underwriting could tighten and 9 percent believe underwriting could loosen. “Each transaction is different, but underwriting metrics really have not changed,” notes Raburn. Some exceptions occur when fundamentals related to the property or the market might warrant a more conservative approach, he adds.

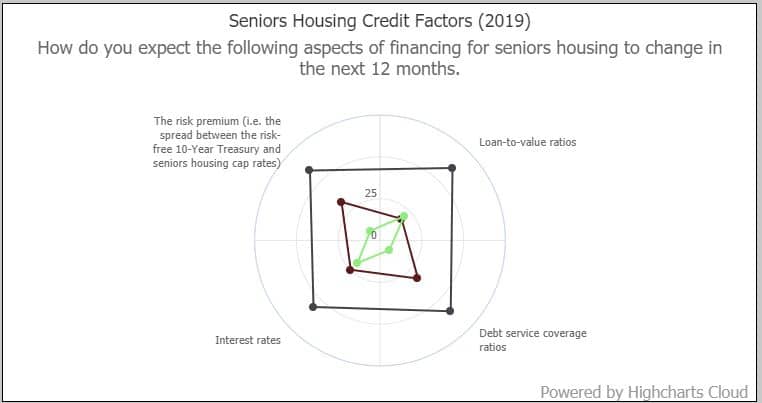

Additionally, 61 percent predict no change in loan-to-value (LTV) ratios and 60 percent expect that there will be no change in the debt service coverage ratio. Although the survey response does show a bit of a disconnect on the outlook for the risk premium given views that interest rates could lower, 59 percent said there would be no change in the risk premium (i.e. the spread between the 10-year Treasury and seniors housing cap rates).

Investors favor high-barrier markets

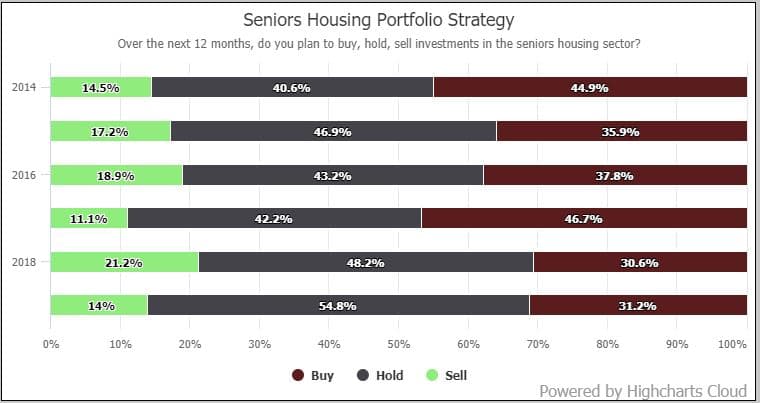

Survey results indicate that respondents’ attitudes towards buying, holding or selling in the sector remain consistent. In all, 31.2 percent said they plan to buy assets over the next 12 months, while 54.8 percent said they plan to hold. Only 14.0 percent are looking to sell. That percentage looking to buy compares to 30.6 percent in the 2018 survey and 46.7 percent in the 2017 survey.

Those numbers could reflect some caution due to increased competition and pricing, as well as concerns about oversupply in some markets. “We are certainly seeing some overbuilding in certain markets. That can’t really be denied,” says Mace. For example, San Antonio at one point in the cycle had 21.6 percent of its inventory under construction. Although occupancies in that market improved to 82.9 percent in the second quarter, that level is still below the national average, which shows it is still catching up to that new supply.

When asked to rate the strength of market fundamentals by region on a scale of 1 to 10, the West/Mountain/Pacific rated the highest at 7.1; followed by the South/Southeast/Southwest at 6.9; East at 6.5; and Midwest /East and West North Central at 6.0. Results show a slight rise in sentiment for the West, up from 7.0 last year, while sentiment declined for the South from 7.2.

That might reflect that the South and Southeast have lower barriers to entry and easier entitlement processes and less regulation, making it easier to build a property, whereas the West tends to have more barriers to entry, limiting new competition, notes Mace.

“Everybody is focused on high barrier to entry markets. That seems to be the buzz word of the day,” adds Blazejewski. Part of that focus is due to the active construction market, as well as a broader trend among baby boomers who want to live in urban, walkable neighborhoods. “A lot of the same trends you see in apartments are now creeping into seniors housing,” he says. Infill projects also tend to be larger and more expensive, which is attracting institutional capital that is looking for scale.

Investors are also more cautious of markets that have experienced a spike in construction and increased competition, notes Bissell. Generally, investors like coastal markets and larger cities, while properties in the middle of the country tend to have the softest demand. The product types that are in most demand are those that offer a continuum of care for independent, assisted living and memory care, with demand that is especially high for West and East coast markets, he says.

Positive outlook on key metrics

Investors are keeping an eye on near-term challenges to the sector, which include rising labor costs that are impacting operating efficiencies. Although respondents are bullish on occupancy and rent growth in the coming 12 months, optimism is somewhat tempered by the fact that those increases will likely be modest. Seventy-eight percent of respondents believe rents will rise, with a mean increase that is slightly less than 1.0 percent. In addition, even though 72 percent of respondents believe occupancies will improve, the mean increase is slight at 21.9 basis points.

The latest NIC data shows that seniors housing occupancy rates in the U.S. have remained relatively stable, declining 10 basis points year-over-year to 87.8 percent in the second quarter. However, this does represent the lowest occupancy level since the second quarter of 2011. Occupancy rates for independent living and assisted living properties averaged 90.2 percent and 85.1 percent, respectively, during the second quarter of 2019.

NIC data also shows a greater disparity in fundamentals across local markets. Among the 31 metropolitan markets that comprise NIC’s Primary Markets, there is a 14.6 percent spread between the markets with the highest and lowest occupancies. San Jose, Calif. is reporting the highest occupancy at 95.7 percent and Houston is reporting the lowest occupancy at 81.1 percent. The variance is due to local market conditions that include economies, barriers to entry and new construction.

“Overall, respondents are definitely still very positive about the sector,” says Mace. “They see a less active construction market and generally improving occupancy rates and rental growth in an interest rate environment that would support continued borrowing and continued development.”

Survey methodology: In June 2019, Informa Engage emailed invitations to participate in an online survey to subscribers of NREI. Informa Engage received 142 completed, qualified surveys. Only respondents involved in seniors housing were qualified to complete the survey.

Written by Beth Mattson-Teig | Aug 29, 2019