While COVID-19 has taken its toll, the exclusive annual NREI/NIC seniors housing investor sentiment research finds that respondents retain a bullish view on the long-term prospects for the sector.

The coronavirus has made its mark on sentiments among seniors housing investors. Exclusive results from the annual NREI / NIC seniors housing investor sentiment survey highlight near-term concerns about pressures on occupancies, expenses and rent growth, while long-term views are optimistic about future performance.

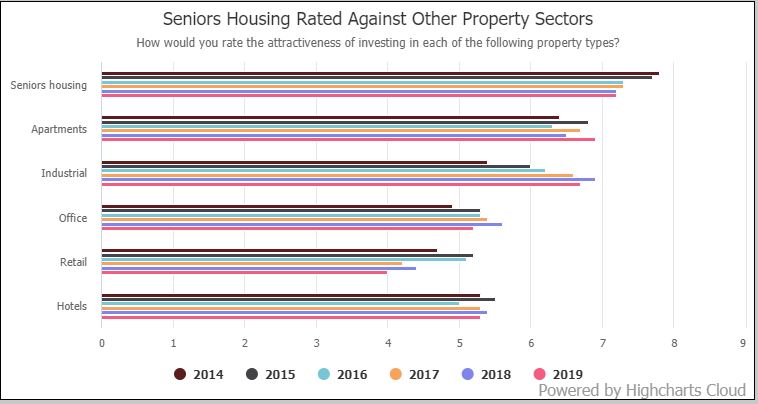

Overall, survey respondents have a less favorable view of seniors housing as an investment property than in past years. When asked to rate the attractiveness of different property types for investment on a scale of 1 to 10, industrial and apartments rated the highest at 7.4 and 7.1 respectively, which is close to past years and meshes with the general market sentiment that those two sectors have been the least affected by the pandemic. All other property types showed a decline compared to past years with seniors housing dropping to 6.3, office to 4.1, hotels to 3.6 and retail to 3.4.

The 6.3 rating for seniors housing is the lowest level that it has been in the seven-year history of the survey. In fact, for the five-year period from 2015 to 2019, respondents in this survey had ranked seniors housing as the most attractive property type.

Seniors have been at the frontlines in the battle with the coronavirus. Although people age 65 and older represent a modest 15.7 percent of total cases of those infected by the virus, they account for 79.3 percent of domestic fatalities, according to data from the U.S. Centers for Disease Control and Prevention.

“I think some of the negative headlines associated with skilled nursing facilities have bled over to seniors housing,” says Beth Burnham Mace, chief economist and director of outreach at the National Investment Center for Seniors Housing & Care (NIC). Negative investment performance in the second quarter is another factor that likely contributed to the decline in sentiment. The NCREIF Property Index showed a total return for seniors housing at -1.0 percent in the second quarter, which was the first negative quarter for the sector since 2012.

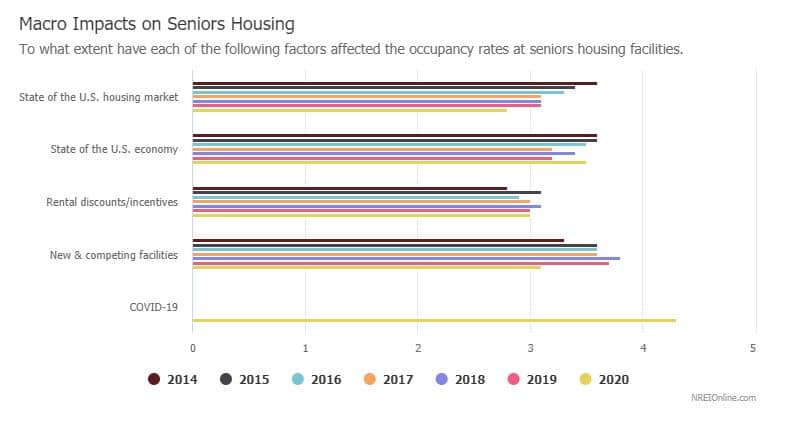

A majority of survey respondents also point to the COVID-19 virus as the biggest factor impacting occupancy rates at seniors housing facilities over the past six months. In all 81 percent of respondents said the pandemic has had at least some impact (65 percent said significant impact), while 55 percent also reported that the state of the economy is having an impact.

“Part of the story for seniors housing is that there is a two-part hit here,” says Mace. One is the negative impacts from the virus on move-in rates and occupancies. The second impact is the sharp drop in the overall economy, which also weighs on seniors housing demand. The economic impact is a little bit more indirect, because it feeds through overall levels of confidence, as well as the impact from lost wealth and wages, she says.

Learn More:

Survey methodology: The NREI/NIC research report on the seniors housing sector was conducted via an online survey distributed to NREI readers in August. The 2020 survey results are based on responses from 167 participants. The majority of respondents hold top positions at their firms with 48 percent who said they were either an owner or C-suite executive. Respondents also represent a cross-section of different roles in the seniors housing sector, including investors, lenders, developers, brokers and owner/operators.

Written by Beth Mattson-Teig | Sep 17, 2020