BY THE CITIZEN ON MAY 10, 2023

DALLAS — Investors are drawn to the fledgling active adult segment for several reasons, according to Caroline Clapp, senior principal, research and analytics, for the National Investment Center for Seniors Housing & Care (NIC).

For starters, it’s a new property type and emerging market that is relatively easy for prospective owners and operators to enter. The average resident turnover per year at an active adult property is 20 percent versus 50 percent for traditional multifamily community, NIC research shows. The average length of stay at active adult communities is six to nine years compared with four years for independent living.

There is also the potential for higher profit margins. Active adult properties can generate a 10 to 30 percent rent premium compared with traditional multifamily properties, which attracts investors.

Caroline Clapp, senior principal, research and analytics, for the National Investment Center for Seniors Housing & Care (NIC).

“That shows the residents will pay a premium to have a little bit of a different lifestyle focus and be among their peers,” said Clapp.

Clapp’s comments during the opening of the third-annual InterFace Active Adult conference held at the Westin Galleria Dallas on Thursday, May 4. The day-long event attracted nearly 365 industry professionals.

Rents for active adult are 30 to 50 percent lower than what independent living facilities charge, the NIC research shows. “Those independent living rates, of course, included a healthcare component,” said Clapp.

NIC defines active adult rental properties as age-eligible, market-rate multifamily communities that are lifestyle-focused. General operations do not provide meals. NIC research shows the average age of an active adult resident is 72 to 74.

Still another factor that piques the interest of investors is that active adult properties require less operational intensity than seniors housing.

“There isn’t any healthcare [component], so there isn’t any healthcare licensing. There are fewer employees. Someone at our roundtable last night was saying it was very appealing going from a property such as independent living where you might have 30 FTEs (full-time equivalents) down to only maybe five to seven,” said Clapp.

Source: NIC MAP Vision

Compelling demographics

There are 10,000 Americas turning 65 years old every day, which means that seven years from now all the baby boomers will be age 65 and above. The 65 to 74 age cohort totaled 33 million in 2020 and is expected to reach nearly 40 million by 2030. “So, this is a very large and immediate pool to draw from for active adult,” said Clapp.

What’s the size of the active adult market? NIC’s data partner, NIC MAP Vision, is currently tracking 625 properties totaling 88,000 units across 135 markets in 43 states. “We think this is pretty comprehensive as far as what’s out there today for the rental market,” said Clapp.

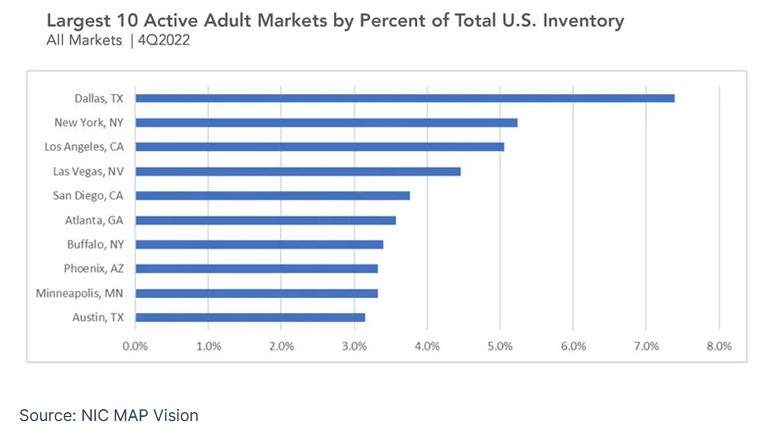

Nearly 90 percent of the inventory is located within the 99 largest metro markets, according to NIC MAP. Dallas boasts the largest share of the active adult market with over 7 percent of the total U.S. inventory, followed by New York City and Los Angeles, respectively, at slightly more than 5 percent.

Seventy percent of the residents of active adult communities come from within a 10-mile radius of the properties, the NIC research shows.

One telling sign that the active adult industry has a lot of runway ahead is the sector’s extremely low penetration rate. Nationally, the ratio of active adult units to households age 65 and older is 1 to 2 percent. By comparison, the penetration rate for seniors housing (households age 75 and above) is 10 to 12 percent.

Clapp urged owners and operators of active adult properties to answer the phone if they are contacted by NIC MAP Vision seeking data on occupancy and rents. Any information provided about the performance of individual properties is kept confidential, she emphasized.

“We’re just trying to get more [aggregate] data so that we can share it with everyone and have a little more transparency.”

— Matt Valley