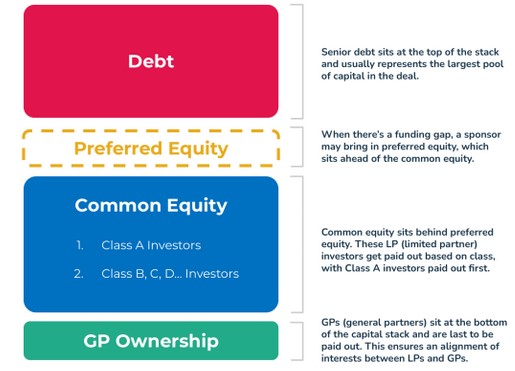

Preferred equity is a type of investment in a senior living company or senior housing real estate project that sits between common equity and debt in the capital stack. The capital stack represents the hierarchy of claims and rights to a company’s or project’s cash flows and assets. The position of each type of financing in the capital stack determines its priority in terms of risk and return.

Here’s a breakdown of preferred equity’s position and characteristics in the capital stack:

- Position in the Capital Stack: From the most senior (least risk) to the most junior (most risk), the capital stack typically consists of:

- Senior Debt: This is the most secure position, often secured by assets or other collateral. Lenders in this position have the first claim on the company’s or project’s assets and cash flows.

- Mezzanine Debt: This is subordinated to senior debt but has priority over equity. It often comes with higher interest rates due to its elevated risk compared to senior debt.

- Preferred Equity: This sits below all types of debt but has a priority claim over common equity. Preferred equity investors have a predetermined dividend, which must be paid out before any distributions are made to common equity holders.

- Common Equity: This is the most junior position in the capital stack and bears the highest risk. Common equity holders have rights to the residual value or profits of a company or project after all other obligations are met.

- Characteristics of Preferred Equity:

- Dividend Priority: Preferred equity typically comes with a fixed or predetermined dividend, which is paid out before any dividends to common equity holders.

- Liquidation Preference: In the event of a liquidation or sale, preferred equity holders are ahead of common equity holders in the line to receive their share but are behind debt holders.

- Conversion Rights: Some preferred equity can be converted into common equity under certain conditions.

- Voting Rights: Preferred equity might have limited or no voting rights, depending on the agreement.

- Cumulative Dividends: If the company or project doesn’t pay dividends in a given period, some preferred equity accumulates those dividends and requires them to be paid out before any dividends go to common equity.

- Uses of Preferred Equity:

- Real Estate: In senior housing real estate projects, developers might use preferred equity as a way to raise capital without adding more debt to the project.

- Business Finance: Companies may issue preferred stock to raise capital without diluting the voting power of the existing common shareholders or taking on additional debt.

In essence, preferred equity offers a balance between risk and return, providing some protection like debt (in terms of payout priority) while also offering potential upside, albeit less than that of common equity.