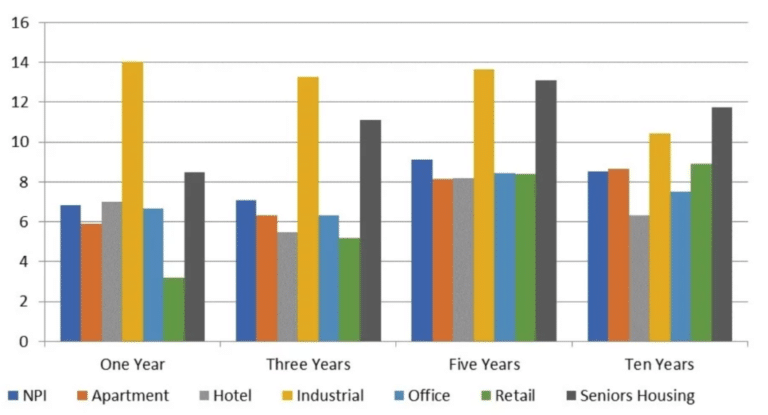

Senior Housing Investment Returns Beat Every Property Type Except Industrial

Senior housing continues to pay off for investors, with only industrial real estate producing higher annualized returns for the period ending Sept. 30, 2019.

That’s according to data compiled by the National Council of Real Estate Fiduciaries (NCREIF), recently shared in a blog by Beth Mace, chief economist at the National Investment Center for Seniors Housing & Care (NIC).

The total annual return for senior housing through Q3 2019 was 7.8%, the NCREIF data show. That compares to 6.24% for the NCREIF property index as a whole and 5.39% for apartments. Senior housing also produced higher returns than hotels, office and retail real estate.

On the tailwinds of e-commerce demand for warehouse space, industrial returns came in highest among the property types, at 13.64%.

For the period ending 9/30/19

Looking at just the third quarter, senior housing returns totaled 2.29%, consisting of a 1.30% income return and 0.99% capital return. That outpaces the average return for the past four quarters, of 1.89%.

“Despite the relatively strong showing for seniors housing, the total annual return has been trending down since mid-2014 when it peaked at 20.37%,” Mace wrote. “This pattern can also be seen in the broader index and reflects where we are in the cycle.”

Meanwhile, value-weighted cap rates for senior housing averaged 5.1% in Q3, according to the data. That continues a compression trend, as cap rates have fallen from 5.8% in 2017.

The NCREIF numbers capture the returns of 124 senior housing properties valued at $6.5 billion as of the third quarter. Thus, it’s a limited data set but reflects the return performance of investment managers who manage or own institutional real estate with a market value of at least $50 million held in a fiduciary setting, Mace noted.