For years, one big question has plagued the active adult senior living sector: What exactly is it? That question now has an answer thanks to a new and significant report from the National Investment Center for Seniors Housing and Care (NIC).

The report, released on Thursday and years in the making, defines the product type in terms of unit count, typical amenities, locations and pricing trends. It also defines the typical active adult resident and what kind of communities they are drawn to.

And while it is still evolving, the report gives the active adult sector a standard definition, at least for now: Age-restricted, market-rate, multifamily housing properties that are lifestyle-focused and do not provide meals through general operations.

The report is also significant given the product type’s meteoric rise in recent years. Investors have warmed to the active adult sector, attracted by plenty of immediate demand, typically longer lengths of stay and potentially higher margins and returns.

The rise of active adult has been compared to the assisted living market in the mid- to late-1990s in the sense that it’s a rapidly evolving product type with sparse data and an opportunity for significant growth ahead. But the product type is now gaining shape and form much in the same way that the senior housing industry did decades ago when it emerged from its nebulous “congregate living” moniker.

With its new report, NIC has defined a new senior living product type for the first time since the 1990s. In the process it has reached a new “milestone,” according to NIC COO Chuck Harry.

“It’s definitely a segment that has … growing interest, not just from the operators or developers in the space, but frankly, the prospective residents and existing residents in the communities,” Harry said. “So, we felt it important, if we’re delivering on our mission as an organization, that we provide coverage relative to this emerging segment.”

The report is also meant to give the industry a common understanding of the product type.

“If we have a common understanding of what [active adult is], and create the connections between the various stakeholders in the space, we can be sure that the segment will continue to benefit, not just the current generation of residents, but the future generations,” he added.

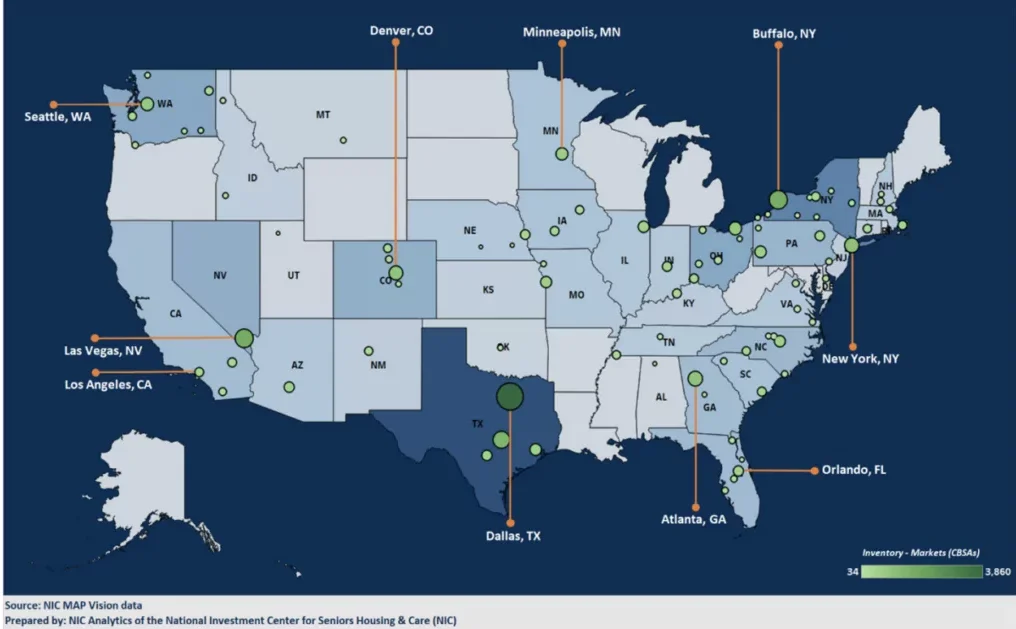

33,000 units, 234 communities, 84 markets, 34 states

Perhaps the most significant aspect of the NIC report is that it has begun to quantify the scale of the active adult market. That has been tough to do, given that these properties are not licensed for care and are not always easily tracked.

Researchers with NIC MAP Vision have tracked about 33,000 active adult units at 234 communities located in 84 markets in 34 states. But that is not the full scope of the market, Harry said.

NIC Active Adult Rental Properties report

“We expect, as we identify more properties in the marketplace, that these numbers will grow dramatically in the near term,” he added. “It’s the beginning of what we expect to be an increasingly robust database.”

In terms of unit count, the typical active adult community has between 140 and 180 units, with dwelling sizes ranging 650 to as much as more than 2,200 square feet — similar to independent living, but with less floor plan variety than a continuing care retirement community (CCRC), according to the report..

That definition excludes communities built using low-income housing tax credits and with single-family, home-only communities. But the report leaves room for active adult-style communities with attached or detached single-family homes, townhomes or cottages.

Instead of congregate buildings with shared entrances, some operators, like Treplus Communities, are building units with individual entryways to the outside.

Typical amenities include outdoor spaces, salons, bars or pubs with liquor lockers, clubhouses, full gyms that may offer fitness classes, dog parks, pools and spaces for sharing meals.

In addition to onsite amenities, they usually give residents access to local parks or trails; and they may include mixed-use dining or retail components, either attached to the community or nearby.

Active adult communities are also typically found in suburban locations near residents’ adult children. While pricing is specific to market and geography, rents usually fall between those seen in multifamily properties and independent living communities.

Compared to independent living communities, active adult communities have fewer full-time staff, more limited liability, more unbundled or contracted service structures and a shorter sales timeframe, the report noted.

Another big difference between the product types is monthly rates, with active adult clocking in at anywhere between 30% to 50% cheaper than independent living.

But active adult communities also do not compete with independent living communities or CCRCs, bucking an earlier notion that the product type could cannibalize demand for more traditional senior living. Instead, active adult communities are more competing with multifamily properties or residents living in their own homes, the report noted.

The properties tend to lease up faster than and carry lower resident turnover than more traditional senior living communities in the range of about six to eight units per month.

The phrase “active adult” is not a new one in senior housing, and has in the past referred more to for-sale single-family homes in larger retirement or master-planned communities a la The Villages in Florida.

But unlike those communities, modern active adult properties are not pure real estate plays given the presence of a light operational component.

“It is advised that anyone trying to ‘come up’ from multifamily be partnered early in the process with experienced developers and operators with a senior housing mindset,” the report noted, echoing a long-held industry notion that primarily multifamily companies risk failure if they move too quickly in the space.

Defining an ‘active adult’

Another important aspect of the report is that it defines the average active adult resident.

The average resident living in an active adult community is in their upper 60s or low 70s, has an annual income of $50,000 and a minimum of $150,000 in non-housing related assets. They are usually renters by choice, and they are already familiar with communal living.

Many are married or widowed, and some are still working a part- or full-time job at the time of their moving in. Lifestyle is a priority for them, and they are looking to thrive in their communities rather than just survive.

One key distinction is that active adult residents are almost always seeking socialization rather than health care, and they usually do not need assistance with daily living, nor do they want it, according to the report.

“Active adult is proving effective in attracting those residents who are interested in thriving within their community and making those connections with their peer group,” Harry said. “It tends to be a slightly younger demographic than is currently being served by seniors housing properties.”

Some older adults are moving to active adult communities as a bridge between multifamily and senior housing, and many are moving to be near grandchildren in what the report calls the “baby chaser” phenomenon

One common warning is that active adult operators risk becoming glorified independent living operators as residents age in place. Operators themselves often voice concerns that adding more support or a new service component such as a meal service would make the community too clinical and drive off future residents.

To that end, the report urged operators to have “honest conversations” with residents about safety, and to help educate their local market on what active adult residency does and does not entail.

“To mitigate market confusion and avoid the pitfalls of moving in people who want an affordable place to live but should be in senior housing, correctly positioning an active adult community will help alleviate attracting prospective residents seeking care,” the report’s authors wrote.

Active adult residents also have a relatively longer length of stay at about six to nine years, which 80% retention in stabilized communities.

55% to 65% margins

The typical active adult model offers some attractive characteristics for investors — chief among them the ability to achieve far higher margins than those seen today in traditional senior living.

With fewer full-time staffers — usually between six and nine — active adult communities have far lower payroll costs than senior living properties. And operators can earn extra revenue by charging residents for add-ons such as garage parking, retail and catering services.

Because active adult properties are less costly to build and operate than senior housing properties it’s easier for those operators to hit their break-even point. CapEx spends are also typically lower for active adult communities, as residents aren’t using as many floor- and wall-damaging wheelchairs or walkers.

At the same time, a relative lack of competition across the country has allowed active adult communities to command rates 10% to 30% higher than multifamily properties.

When taking all of that into account, active adult properties with higher rents, lower expenses and longer lengths of stay can achieve margins of as much as 55% to 65%, according to the report.

Although underwriters typically see active adult as riskier than pure multifamily, they do not view them as risky as senior living communities higher up on the acuity ladder. Thus, communities are often valued between IL and multifamily.

With active adult now defined, NIC MAP Vision is now collecting more robust operational data on the sector. And Harry reiterated the organization is still “only at the beginning” of its data collection.

“Our intent is to continue to build on the transparency in this sector, and provide the resources behind it so that we can be giving insights so that those stakeholders in the space can make informed decision on the behalf of those residents,” he said.

By Tim Regan |