United States Senior Housing Investments

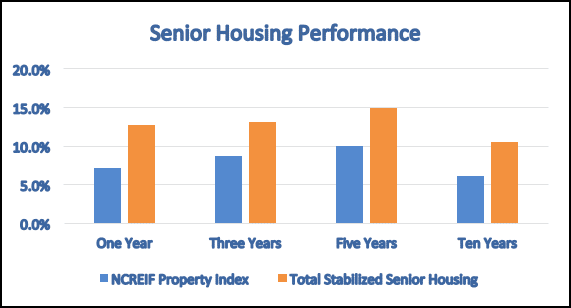

We believe the sector has typically been recession-resilient, and the current demographic trends driving demand are attractive today as the Baby Boomer generation ages. Although average occupancy rates declined to just below 87.0% during the Great Recession, annual net absorption and rent growth was positive. Despite the overall condition of the economy, people still age, get sick, become injured, and require care for disabilities. Senior housing generated annualized total returns that outperformed the broader real estate market over the past ten years through March 31, 2018, a period that cycled through the downturn, and experienced the recovery after the economic downturn. As outlined in below, according to NCREIF, a quarterly index of private commercial real estate properties, senior housing generated annualized total returns of 10.52%, versus 6.09% for the broader NCREIF NPI during this ten-year period.

Join now to learn how you can profit from the latest Senior Housing and Assisted Living Investments. Get insider access to passive or active income opportunities in real estate’s most recession-resilient asset class.

Information on this page is not an offer or a solicitation to sell or purchase securities. Statements, descriptions, and data on this page are for informational purposes only and relate to an investment opportunity that may be offered in the future. No offer or solicitation will be made until the necessary final documentation and agreements have been delivered to you. Forward-looking Statements. The Fund is including the following cautionary statement in this executive summary to make applicable and take advantage of the safe harbor provisions of the Private Securities Litigation Reform Act of 1995 for any forward-looking statements made by, or on behalf of, the Fund. Forward-looking statements include statements concerning plans, objectives, goals, projections, strategies, future events or performance, and underlying assumptions and other statements which are other than statements of historical facts. All such subsequent forward-looking statements, whether written or oral and whether made by or on behalf of the Fund, are also expressly qualified by these cautionary statements. Certain statements contained herein, including, without limitation, those that are identified by the use of the words “anticipates,” “estimates,” “expects,” “forecasts,” “intends,” “plans,” “predicts,” “projects,” “believes,” “seeks,” “will,” “may” and similar expressions, are “forward-looking statements” as defined by the Private Securities Litigation Reform Act of 1995. Forward-looking statements involve risks and uncertainties, which could cause actual results or outcomes to differ materially from those expressed in the forward-looking statements. The Fund’s expectations, beliefs, and projections are expressed in good faith and are believed by the Fund to have a reasonable basis, but there can be no assurance that management’s expectations, beliefs or projections will result or be achieved or accomplished.