C-PACE Financing for Assisted Living and Senior Housing

Senior Housing and assisted living building owners and developers choose C-PACE financing in 2025 because it:

- Covers 100% up front financing, including project development costs.

- Provides long-term funding that can result in immediate benefit to cash flow.

- Solves split incentives by passing payments to tenants.

- Preserves working capital and can improve property NOI.

- Increases building value and marketability.

- Offers a range of accounting treatments.

Many C-PACE programs across the U.S. now offer financing for senior housing new construction and gut rehab projects in addition to retrofits.

WHAT IS PACE?

Property Assessed Clean Energy (PACE) is a financing mechanism that enables low-cost, long-term funding for energy efficiency, renewable energy and water conservation projects. PACE financing is repaid as an assessment on the property’s regular tax bill, which generates benefits that aren’t available through conventional forms of funding.

100% FINANCING

20 YEAR FINANCING TERM

- PACE allows financing terms up to 20 years, not to exceed the average useful life of the improvements.

- Enables deep retrofit projects with paybacks of 20 years, rather than only low-hanging fruit with quick paybacks.

- Allows comprehensive senior housing projects with deeper impacts on energy usage and significant effects on the bottom line.

- 20 year amortization makes it possible for annual energy savings to exceed annual PACE payments.

ALIGNED LANDLORD & TENANT INTERESTS

- PACE assessments are part of a property’s regular tax bill, so the cost of financing (along with the benefits) can be shared with tenants under most lease forms.

- PACE eliminates the split incentive issue that derails many energy projects.

TRANSFERABILITY

- PACE financing is attached to a building through a tax assessment; it’s not attached to an individual or business.

If the building is sold before the - PACE assessment is paid off, it seamlessly transfers to the new owner as part of the taxes. The savings from the energy project transfer to the new owner too.

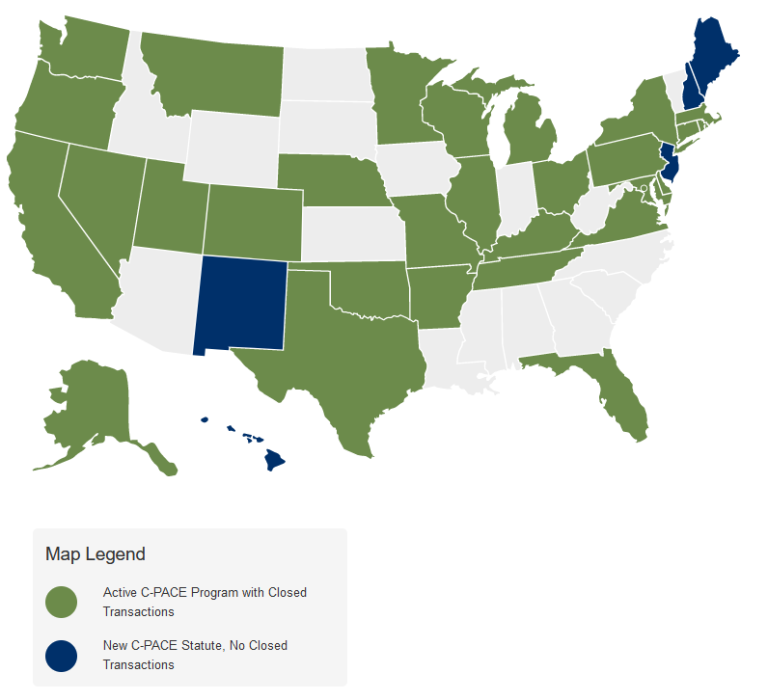

States that DO NOT have active PACE programs.

- Idaho

- Wyoming

- Arizona

- Kansas

- South Dakota

- North Dakota

- Iowa

- Louisiana

- Mississippi

- Indiana

- West Virginia

- South Carolina

States that have PACE programs in development.

- New Mexico

- Maine

- New Jersey

States that have passed Legislation but no program under development.

- Alabama

- North Carolina

- Vermont

- New Hampshire

C-PACE stands for Commercial Property-Assessed Clean Energy, and it is a financing structure that allows building owners to borrow money for energy efficiency, renewable energy, or other projects, and repay it via an assessment on their property bill.

C-PACE financing offers borrowers SIGNIFICANT benefits, like:

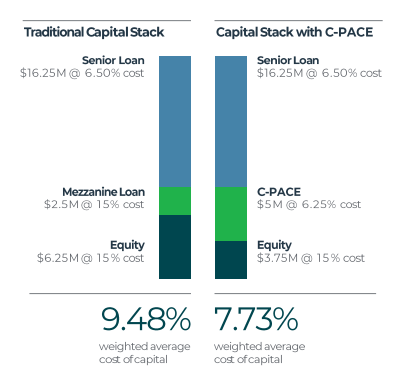

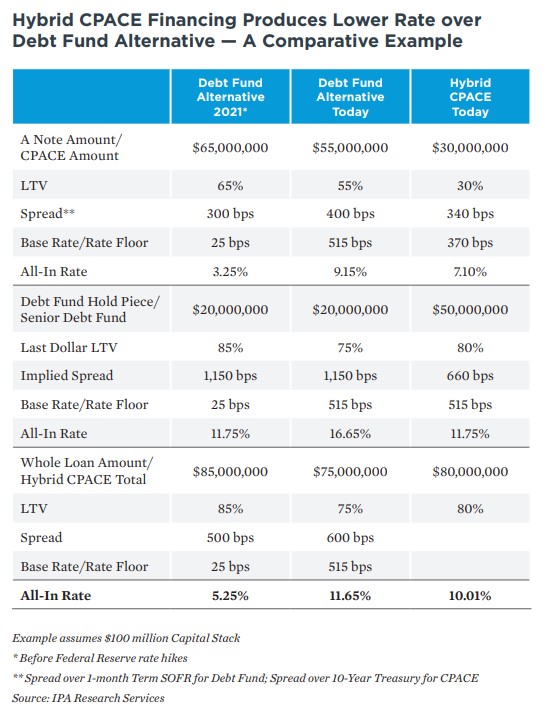

-Lower cost, more efficient capital stack

-Longer-term, fixed-rate financing

-Decreased operational costs

-Increased property value

And, since the financing is executed via a tax assessment, it is fully non-recourse. Plus, extended repayment terms allow owners to realize increases to cash flow quicker to maximize return.

C-PACE is a smart financing solution that makes an IMPACT for our clients and the environment.

*Rates are changing every day. Call us for the latest rates.

C-PACE FINANCING KEY PLAYERS:

The property owner: provides detailed costs on the energy upgrades for retrofits or ground-up construction.

The pace financing administrator: knows the ins and outs of the program as it relates to that state’s legislation.

The lender: finds the right administrator for the location of the project, structuring and facilitating the financing process.

Reach out to us to see if your next transaction is eligible.